If you want to try and make a serious stab at getting on over on the bookies on a regular basis… try something easier, like brain surgery, or trying to beat a computer at chess. But seriously, just like both of those things – well, actually, not like both of those, given modern computing power but at least akin to brain surgery – it is possible, just very hard.

If you want to try and make a serious stab at getting on over on the bookies on a regular basis… try something easier, like brain surgery, or trying to beat a computer at chess. But seriously, just like both of those things – well, actually, not like both of those, given modern computing power but at least akin to brain surgery – it is possible, just very hard.

If you want to try to improve your overall betting results, then fully understanding odds is central to that. The only way to win in the long term when it comes to taking on a bookmaker is to understand value and, more accurately, to be able to identify it. Value confuses many, but in the simplest terms a value bet is one where the odds are longer than they should be based on the probability of the selection winning.

To spot odds that represent value it helps a great deal to know how bookmakers set their prices in the first place. The more fully you understand everything connected to betting odds, how they are formulated, why they are set how they are, and the reasons they may change, the better placed you are to uncover value. Full and thorough knowledge of the sport and event you are planning to bet on is essential too, of course, but without understanding how traders set their odds and the various factors that could make a price change, you only have one half of the puzzle. Or maybe you just wondered how bookies set their odds, who knows? Either way, we have it covered here.

See Also: How Much Do Odds Vary Between Betting Sites?

How Do Bookies Decide on the Odds

The precise mechanics and processes vary depending on a host of factors, the most typical ones being the bookie in question, the event and the market. However, fundamentally, the most important factor and the starting point will be how likely the trader thinks an event is to happen.

What Is a Trader?

Before we look at how a trader might come up with the prices that they do, it might be worth looking at who, or what a trader is. We don’t mean someone who trades stocks and shares, although there are similarities. Nor do we mean a trader in the sense of a shopkeeper or market trader – although there are also, less obvious, similarities there too.

A trader, who might also be known as an odds trader or, often, odds compiler, is the person at a bookie who is – or perhaps was, as we shall see – responsible for coming up with the odds for the various selections in any given market. They generally also undertake other roles, including adjusting odds as a market develops, monitoring customer accounts, shaping promotions and other related activities.

Probability Key

Unsurprisingly, the odds compiler compiles odds! But how? Why is a horse 25/1 and not 2/1? Why are Man City 1/8 to beat Sheffield United and not 8/1? Well, anyone with an interest in horse racing or football would sort of instinctively know why that was the case, though they might have never really thought about it or given it a name.

It all really comes down to probability. A horse that has consistently struggled to even place at the grade will be priced at long odds. Assuming it is racing over the same sort of course and distance (and with other variables unchanged, such as the surface, going and nature of the track, for example), there is no real reason to think it will win. As such, 25/1 is a price you might expect, whilst the favourite, who has won at the course before and perhaps triumphed in its last race, might be 2/1. It simply has far more chance of winning, so the odds are lower.

Likewise, most football fans would fully expect Man City to beat Sheffield United. If the teams played each other 100 times under the same conditions, City would win the vast majority of those games. As such, they cannot be 8/1, as the bookies would rather rapidly go bust!

Betting sites have to shape the odds so that they make money and a simple way to think about this is to imagine that a given event has a 50% chance of winning. If a bookmaker offered odds of evens on that event, they would win the value of the money staked half the time, and lose the same amount half the time as well. As such, they would break even, though this equation would not include their costs, such as staff, rent and marketing, nor any taxes due, nor anything for their shareholders!

Implied Probability & Overround

What bookies do, therefore, is try and calculate the probability of an event happening and then create odds based on that which factor in a margin for them. A range of terms are used interchangeably to describe this margin, although some of them technically differ slightly from others. It may be called the overround, the house edge, the vig (short for vigorish), or simply the margin.

Once an odds compiler, or trader, has calculated what they believe the probability of, say a horse winning a race, is, they effectively convert this into odds, but make the odds smaller to generate their margin. Once again keeping things simple, if they think a horse had a 50% chance of winning a race, the odds might be 10/11, 5/6 or perhaps 4/5, rather than the evens (1/1) that would, strictly speaking, be “fair”.

The term “implied probability” is fundamentally the conversion of odds into probabilities. Odds of evens have an implied probability of 50%. Bookies essentially work the other way around, converting probabilities into odds – with their margin factored in. However, punters should think about implied probability when placing their bets.

One can calculate this by dividing one by the decimal odds of a selection: hence evens, 2.00, gives an implied probability of 50% because one divided by two is 0.50. If you can find such a selection at those odds that you think has a 60% (or anything over 50%) chance of winning, this will be a value bet.

Some Markets Easier Than Others

The hard part of all this is actually working out what chance a horse, team, player or whatever has. This, in many ways, is the real job of a trader. Clearly, an odds trader’s task is much easier in some sports, events and markets than others. The simplest example of a market where calculating the odds is very easy is perhaps the only bet where the true probabilities are known rather than estimated.

In cricket, for example, it is possible to bet on which side will win the toss before a game and there are other loosely similar markets. With markets such as this, the trader’s only real job is to decide what margin they want to build into the odds, as the probability of each outcome is fixed, rather than requiring an estimate. No matter if one skipper has won the last 10 tosses and the other has lost the previous 20, this remains a 50/50 bet. In other words, both have exactly the same chance of winning and the true odds would be evens (1/1, or in decimal, 2.00).

Of course, no betting site will ever offer odds of evens and they will certainly not have a price bigger than that, which would be the requirement for a value bet as far as a punter is concerned. As such, this is not a wager we would recommend anyone ever makes. However, in general the job of an odds compiler is far trickier. There are a number of factors that affect how hard it is to make an accurate prediction and these include:

Variables

The more variables that are involved and have to be accounted for, the harder it is to correctly assess the probability. So, for example, golf events where bad weather is forecast are harder to predict than ones played in perfect conditions. The weather adds another layer of unpredictability and this is true in general terms where there are more “moving parts” to the sport or event.

Role of Luck

Luck plays a bigger role in the Grand National than it does in a five furlong sprint on the flat. Likewise, luck is a bigger factor in lower-scoring games, like football, than it is in high-scoring ones like basketball. One bad decision by the ref, or one terrible error by a goalkeeper can turn a game of football, whilst in sports like rugby or basketball this is not the case.

Number of Outcomes

Related to the two points above, the more possible outcomes there are, the harder it is to predict what will happen. A horse race with six runners is generally easier to predict than one with 20, whilst a golf tournament with well over 100 players involved is harder still.

Smaller Sports & Leagues

The more information that is available about a market, the more accurate the odds will generally be. For example, there will be less information, news, statistical data and analysis for a game of football in the Bolivian second division than there will be in the English Championship. Related to this, the more money that is wagered on a sport, the more time and resources bookies will put into ensuring their odds are accurate.

How Do Traders Assess the Probabilities?

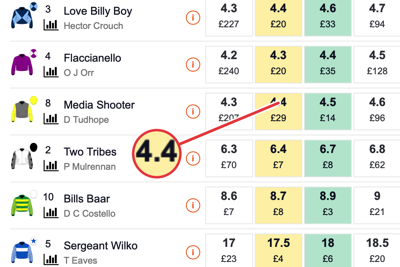

Traders look at all of the available information, including form, recent results, etc.

Now we understand the basics of how odds and implied probability relate to each other and that some markets are easier to predict than others, let’s look at how the odds compilers go about trying to determine the chances of any given selection winning. Clearly some markets, like the aforementioned coin toss, are straightforward, and the probabilities are actually known. But most are far more complex and if the market is one where lots of money will be bet, the oddsmakers will do everything they can in order to get their initial prices as accurate as possible.

Fundamentally, traders work in just the same way that punters do – or at least how punters should. That is to say they look at all the available information to try and form a prediction of what they think will happen. Anything at all that might affect a race, match, fight or other event will be factored in and in the modern age that means an increasing use of data, algorithms and even AI. Factors they consider will vary depending on the sport and event but in general include:

- Form, including recent results and those over a longer period

- Quality of previous opponents versus current one

- Form/record at the specific venue

- General ability/class

- Head to head record

- Assessment of performances rather than results

- Motivation

- Pressure factors

- Home advantage

- Fitness, including team news, injuries and suspensions where relevant

- Travel and preparation

- Morale and confidence

- Weather and conditions, for example the ground in racing

- Personal issues with players, jockeys, managers, and so on

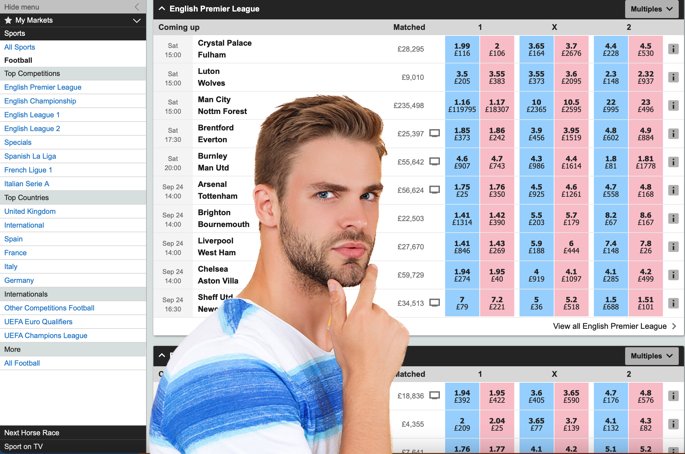

Some of these factors are clearly more stats-based than others. For example, in football, if a team has won their last three matches and has beaten the current opponent in the last four games, these are simple facts. If this information was added to the fact that the opposition had lost their last three matches, it would be quite easy to establish that the first team should be strong favourites. That feeling would be strengthened further if both teams had played the same sides in their previous three clashes, making a comparison fairer.

Home advantage can also be quite easily quantified statistically, though here we get into slightly muddier waters. Analysis could simply look at what advantage playing at home gives historically speaking, or it could look at the particular team, or it could focus on the team over the last five matches, last 10… or more. That’s before we even get to considering how the other team have performed on the road!

It is clearly a very complex business. For this reason, odds traders, pro gamblers and others with an interest in predicting the outcome of events, from football to horse racing, or the winner of Strictly Come Dancing or an upcoming by-election, tend to use models to try and forecast what will happen. Some of the more statistical info is easier to model and experts can use past events to hone their forecasts by isolating what impact on the outcome each separate factor had.

The growth of stats, huge increases in computing power and the rise in the use of AI have meant that more and more of the work of odds traders is done in a scientific, mathematical fashion. However, there is still scope for traders to use their intuition, experience and expertise away from an algorithm.

Traders are often huge fans of the sport on which they set the odds. In the same way that a human football scout may pick up on a player that the stats staff have missed, and who turns out to be a great footballer, a wily veteran of the odds game may “see” something that the bookmaker’s modelling cannot. There are certain intangibles, from what may be described as a “hunch”, to something slightly more understandable, such as an understanding of a team or player’s will to win and how they handle pressure.

There is so much variety within this area and some factors that we currently class as intangible, may in time become ones that AI and modelling can account for. For example, in a penalty shootout, an automated system cannot currently factor in a player’s body language and instead must rely on past data for that player, and other players, in the same or similar situations. Or even just as simple a metric as how often penalties are scored.

In contrast, an experienced football trader may be able to assess the player’s demeanour and walk to the spot, as well as the atmosphere inside the ground. Using this, they may be able to ascertain with far greater accuracy the chance of the player scoring or blazing their kick over the bar. However, perhaps in time, AI will be able to recognise body language, a player’s walk to the spot, how they place the ball and their facial expressions.

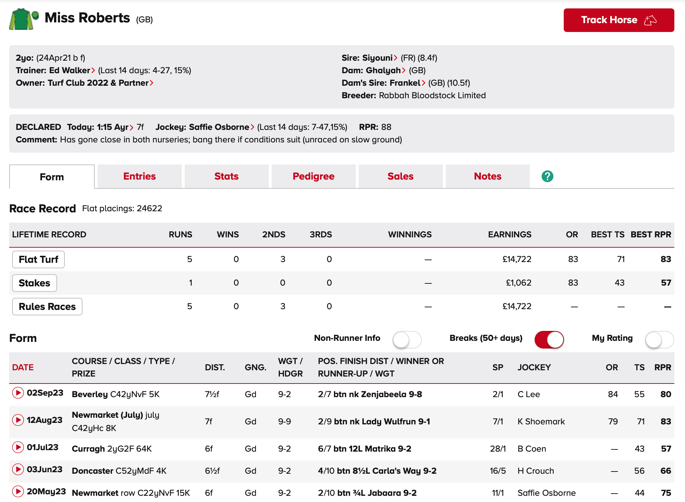

Performance Not Results

Also, perhaps, falling into this area where hard data and more advanced human techniques can blur is the issue of distinguishing between results and performance. If a horse has finished outside the places in its last five races, it is likely to be given little chance by anyone only considering the results. However, it is possible that there are clear explanations for those bad results that aren’t necessarily obvious, certainly not to a computer model.

Perhaps it ran on the wrong side of the track in one race, had a terrible ride from a stand-in jockey in another, was badly hampered through no fault of its own in another two, and lost a show in the fifth. Such factors could, in theory, be allowed for by an advanced algorithm but could just as easily be missed, or inaccurately calculated.

A similar scenario exists in football, where a side might have lost three games in a row, 3-0. Football punditry, supporters and media reporting are so results-focused that the narrative will almost certainly be that the side played badly in all three games and, therefore, is unlikely to win its next match.

However, cold-headed analysis reveals that, unlikely as it sounds, they dominated all three games but were undone by a combination of appalling referring decisions, bad luck, inspired goalkeeping and unlikely-to-be-repeated striker errors. Increasingly, through the use of stats such as xG and xGOT, such games can be considered more accurately. Even so, there are times when an expert’s view of a clash will give a far better understanding of how a team performed (and thus how they might do so in the future) than a computer or cold hard stats will.

Do Bookies Still Use Odds Traders?

Whilst we have talked about odds traders a lot, increasingly bookies are using these experts less and less. There are many experts and gambling enthusiasts who verge on being full-time professionals who believe that many large UK bookmakers now largely derive their prices from a small number of Asian market-makers.

Huge sums of cash are wagered in legal, semi-legal and illegal Asian betting markets. Sometimes bets are made through or on behalf of syndicates, using betting brokers, and it is thought that many UK bookies simply use the odds as set by the big players in Asia. By outsourcing in this way they are able to save money but are still free to alter the odds if they wish.

Ultimately though, whether the odds are being made by a bean counter in Leeds or London, or one in Bangkok or Hong Kong, the process is largely the same. The odds trader might not work for a major UK bookie but they still do the same job, in the same way.

Why Do Odds Change?

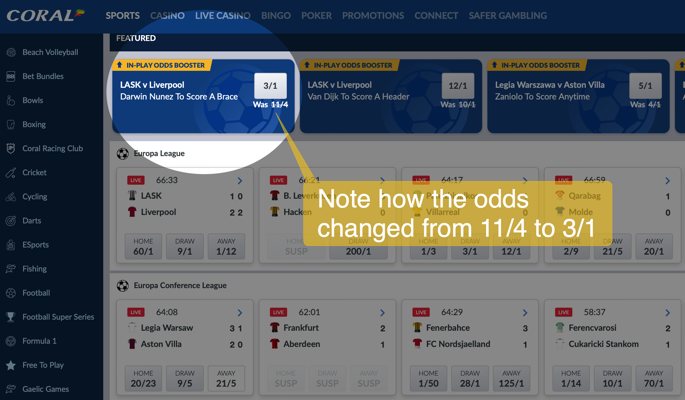

Odds tend to be quite fluid and they change as new information comes in or the volume of bets swings too heavily in one direction. Common reasons for movement in the odds are:

Injury

Let’s say that a horse’s first-choice jockey gets injured in a fall the day before a major race. A new jockey will now be riding the horse who is both less skilled and less familiar with the horse in question. It is fair to assume that this affects the animal’s chances of victory and so the bookie increases the odds of it winning and slightly reduces the price of the other horses in the race.

Money Wagered

The other key driver of a price change is money being wagered. Let us imagine that a bookie has one team priced at 10/11, the draw at 12/5 and the second side priced at odds of 16/5. If the site receives lots and lots of cash in support of the outsider, they will change their odds. This is partly because they want to maintain a broadly balanced book (of which more below) but also because there is a good chance this is a reaction to some new information.

Leaked Information

This may be information that never comes to light publicly or it may simply be that punters have discovered something ahead of the bookies. Perhaps the team doctor of the side priced at 10/11 has told friends that five of their best players have got food poisoning ahead of the game. Those friends then decide to have bets on the opposition and they also tell their friends who do likewise. Technically speaking, this would fall into a legal grey area with regard “insider trading” but in reality nothing would probably happen.

However, that money would be enough to see bookies react and change their odds. Alternatively, it could be something less contentious, such as punters jumping on very quickly at the long odds as soon as it is announced that the manager of the favourite intends to rest their best two players before a big Champions League game.

Do Bookies Aim for a Balanced Book?

We mentioned a balanced book above and this is the idea that the bookies change their odds to try and create a situation where no matter what happens in an event, they make the same amount of money. As discussed above, the overround gives the bookmaker an edge and so if there is a two-horse race between well-matched animals, both may be sent off at 10/11, rather than the “fair” price of evens.

If the bookie attracts exactly £11 of stakes on both horses then they will end up collecting £22 and paying out £21 (£10 innings and the £11 of stakes) no matter which horse triumphs. Bookmakers will often change their odds in order to attract stakes on selections that will yield them the biggest overall win and discourage stakes on ones where they have already accepted a lot of bets and stand to be down overall if that pick wins.

Getting a 100% balanced book is almost impossible and often a bookmaker will lose if the favourite wins, especially in a big contest. To balance the book would mean them offering a very uncompetitive price on the favourite and this could attract negative publicity. It might also mean offering odds that are far too big on an outsider which could leave them vulnerable.

That said, most of the time, changes in odds are at least in part driven by the bookmaker’s desire to keep some semblance of a balanced book. They want a situation where most, or all, outcomes leave them to the good. At the very worst they usually want to make sure that no particular winner leaves them nursing a substantial loss. Ultimately, this last consideration can perhaps be seen as the main driver of changes in odds. It will be caused by other underlying factors as discussed, but at the end of the day, money does most of the talking!